Ohio Medicaid Income Limits (2026): the numbers, the common sticking points, and what to do next

If you’re trying to get help for yourself or a loved one through Ohio Medicaid, you’ve probably noticed something quickly: the care decisions are hard enough, and the financial rules can feel like a second job.

You’re not alone in that.

Income limits are often the first “gate” families run into—especially when the goal isn’t just health coverage, but in-home support through programs like PASSPORT, MyCare Ohio, or Structured Family Caregiving.

This guide keeps it simple: which category you’re in, what the 2025 income limits look like, when assets matter, and where to go next.

Figure out which Medicaid category applies

Ohio Medicaid has different eligibility categories, and each category has its own income rules. The easiest way to start is to place yourself (or your loved one) into one of these groups:

- Parents and Caretakers: generally family members raising children such as grandchildren, nieces/nephews, etc.

- Adults ages 19–64 (no Medicare): often called Expansion Medicaid

- Children and pregnant people: often through Ohio’s Healthy Start coverage

- Seniors (65+) and people with disabilities: often called ABD Medicaid (Aged, Blind, or Disabled)

- People applying for long-term care or Medicaid waivers: similar to ABD, but with long-term care financial rules and a required “level of care” assessment

If you’re exploring home-based support, it can also help to read our overview of waiver options here: Ohio Medicaid Waiver Guide

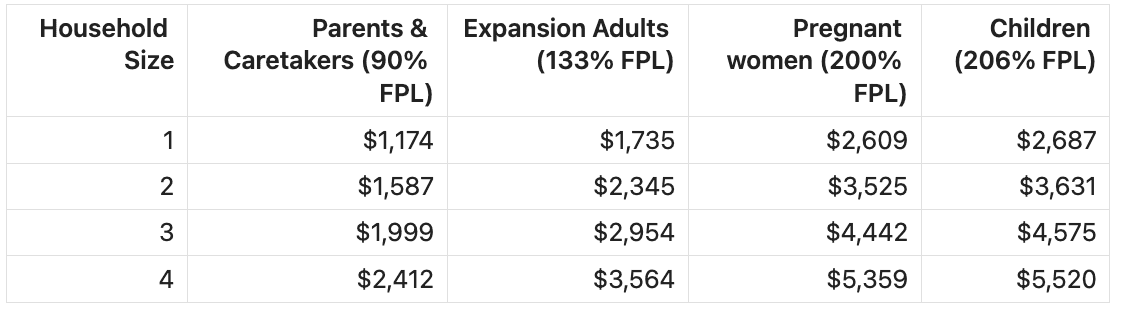

2025 income limits in Ohio (quick chart)

Many Ohio Medicaid categories use percentages of the Federal Poverty Level (FPL) to determine their financial eligibility according to their gross income. Below are monthly income amounts for some of the most common Modified Adjusted Gross Income (MAGI) groups.

source Note: Some 2026 figures have not yet been published by the state as of the writing of this blog. Where 2026 numbers are unavailable, 2025 figures are used and will be updated as new data becomes available.

A few helpful reminders:

- Household size matters (and it isn’t always as simple as “who lives in the home”). Taxes and dependents can change how Medicaid counts a household.

- These figures are about income. Whether savings matter depends on the category (see the asset section below).

- If you’re slightly above the limit, it may still be worth applying—some applicants qualify due to how income is calculated.

If you’re applying for PASSPORT, MyCare Ohio, or other long-term care support

If your goal is in-home long-term care services (or support that helps someone stay out of a nursing facility), you’re usually dealing with the long-term care/waiver side of Medicaid eligibility.

In many long-term care pathways, Ohio uses a separate “special income” cap. A commonly used figure for 2026 is:

- $2,982 per month

This part matters if you’re trying to access programs such as:

- PASSPORT (older adults): Exploring the PASSPORT Waiver

- Structured Family Caregiving (paid live-in caregiving in certain waiver arrangements): Structured Family Caregiving guide

- A broader step-by-step application walk-through: How to Apply for Caregiving Benefits in Ohio

Asset limits: when savings count (and when they don’t)

This is one of the biggest points of confusion, and it’s also where people sometimes assume they’re disqualified when they aren’t.

- Expansion Medicaid / children / pregnancy coverage: typically no asset test (meaning savings and resources are usually not part of eligibility).

- ABD Medicaid and long-term care/waiver pathways: typically do have an asset/resource limit (often around $2,000 for an individual, with different rules for couples).

Assets can include things like cash, checking/savings accounts, and some investments. Certain items—like a primary residence and car—may be treated differently depending on the situation. If assets are a concern in your case, it’s worth getting help early so you don’t rely on assumptions.

If you’re over the limit, you may still have options

Seeing a number that’s higher than the chart can feel discouraging. But “over the limit” doesn’t always mean there’s no path forward.

- MAGI categories (Expansion, many children/pregnancy cases): a 5% income disregard can help some applicants who are near the cutoff.

- Medicaid Spend-Down: If your income is above the limit but you have regular medical expenses, you may be able to "spend down" the excess each month by applying medical costs toward your eligibility—once your medical bills equal or exceed the amount you're over the limit, you can qualify for Medicaid for the rest of that month.

Because these situations are fact-specific, many families choose to apply anyway and follow up with the agency handling the case, rather than ruling themselves out upfront.

How to apply for Medicaid in Ohio

You can apply in any of these ways:

- Online: Ohio Benefits portal (benefits.ohio.gov)

- Phone: Ohio Medicaid Consumer Hotline: 1-800-324-8680

- In person: your County Job and Family Services (JFS) office

A few documents that often help:

- ID and proof of Ohio residency

- Proof of income (pay stubs, Social Security award letter, pension statements, etc.)

- Medicare card (if applicable)

- Basic household information

If your goal is paid caregiving or in-home waiver services after Medicaid approval, this guide lays out the next steps: How to Apply for Caregiving Benefits in Ohio (PASSPORT, MyCare Ohio, and Structured Family Caregiving)

Choose the path that fits your situation

If you’re looking for support at home, the most helpful next step is usually to match the right program to your situation:

- Seniors who want to remain at home: PASSPORT Waiver guide

- Live-in family caregiving arrangements: Structured Family Caregiving guide

- A practical step-by-step application guide: How to Apply for Caregiving Benefits in Ohio

- On a MyCare plan already? Here's what's changing in 2026: NextGen MyCare – What you need to know for 2026

If you want help understanding which program fits your goals (and what the application process looks like), you can also contact CareOasis to talk through next steps.

Get support for your caregiving journey today

We help you get certified as a caregiver and enroll in federal programs to receive compensation for family caregiving. Start your CareOasis journey now.